Most founders pour energy into product development, hiring, and fundraising, then treat taxes as an afterthought until April arrives. That's a costly mistake. Tax planning for startups isn't just about filing returns on time; it's about structuring your business to preserve cash and extend your runway from day one.

Early-stage companies face unique financial pressures, and the tax code offers real opportunities to ease them. R&D credits, qualified small business stock exclusions, and entity selection all shape how much money stays in your business versus flows to the IRS. Missing these strategies in your first few years can mean leaving tens of thousands of dollars on the table, capital that could fund another hire or another quarter of operations.

At Tax Experts of OC, our CPAs and Enrolled Agents work with founders across all 50 states to build tax strategies that actually fit startup realities. This guide covers the deductions, credits, and cash flow tactics that matter most when you're building something from scratch.

Why tax planning matters for startups

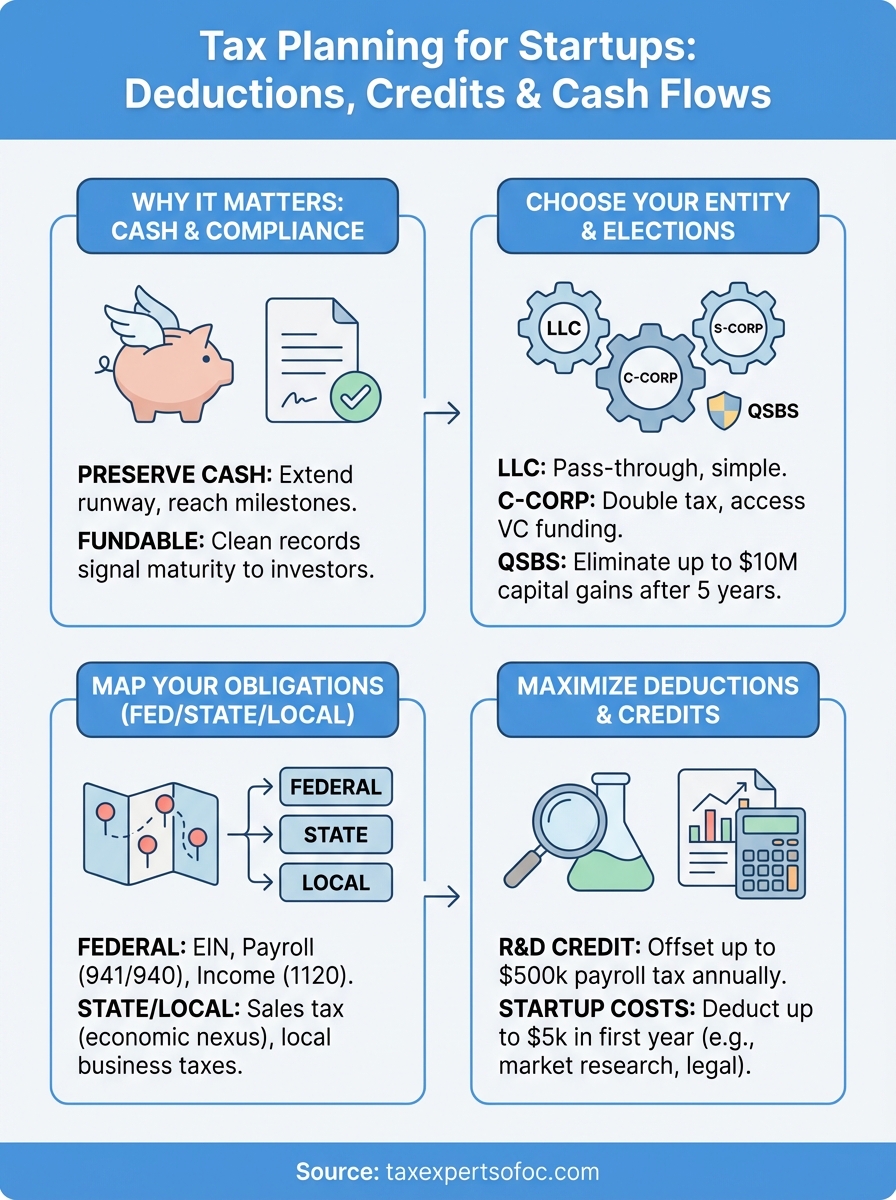

Your startup's survival depends on how long you can operate before revenue catches up to expenses. Strategic tax planning directly impacts that timeline by keeping more capital in your business instead of sending it to tax authorities. Every dollar you save through proper deductions and credits extends your runway by days or weeks, giving you more time to reach product-market fit or close your next funding round.

Cash preservation in early stages

Most early-stage companies operate at a loss, but you still face payroll tax obligations, sales tax filings, and estimated tax payments if you have any consulting income or early revenue. Getting these wrong means penalties that drain your limited cash reserves. You also miss opportunities like the R&D tax credit, which can return 6% to 10% of qualified development expenses as a direct offset against payroll taxes, even before you turn a profit. Planning ahead lets you structure contracts, track expenses, and document activities in ways that maximize these benefits instead of scrambling to reconstruct records at year-end.

Tax planning for startups isn't about gaming the system; it's about using legal provisions designed to support innovation and growth.

Compliance keeps you fundable

Investors conduct tax due diligence before they write checks. Clean tax records and timely filings signal operational maturity, while outstanding liabilities or inconsistent reporting raise red flags that can kill a deal. If you've misclassified employees as contractors or skipped state registrations in markets where you operate, those issues surface during diligence and create negotiation leverage for investors or even derail the round entirely. Proactive tax planning means you address these structural questions early, when fixes are cheap and straightforward, rather than under pressure during a funding timeline. You also build relationships with qualified advisors who can support diligence requests quickly, keeping your fundraising process on track.

Choose the right entity and tax elections

Your legal structure determines how much tax you pay and when you pay it. LLCs, C-corporations, and S-corporations all face different federal and state obligations, and switching entities later creates complexity and expense you don't need. The choice you make in month one affects your personal liability, investor appeal, and eligibility for benefits like qualified small business stock (QSBS) treatment.

Entity selection shapes your tax bill

Most founders default to an LLC because it's simple to form and offers pass-through taxation, meaning profits and losses flow directly to your personal return without corporate-level tax. That works well if you're bootstrapping and expect early losses to offset other income. C-corporations face double taxation on profits, first at the corporate level and again when you distribute dividends, but they unlock access to venture funding and QSBS exclusions that can eliminate up to $10 million in capital gains when you exit. If you plan to raise institutional capital or sell the company in five to ten years, the C-corp structure usually delivers better long-term outcomes despite the upfront complexity.

S-corp and QSBS elections

You can elect S-corporation status to avoid double taxation while still operating as a corporation, but investor restrictions and one-class-of-stock rules limit its usefulness for startups seeking outside capital. QSBS requires you to file as a C-corporation at issuance and hold shares for at least five years, so tax planning for startups often means committing to that structure early. These elections carry strict deadlines and documentation requirements, so you need qualified advisors to file correctly and preserve the benefits down the road.

Missing the QSBS election at incorporation can cost founders millions in avoidable capital gains taxes at exit.

Map your federal, state, and local obligations

You face tax obligations at three different levels, and each one carries separate registration deadlines, filing schedules, and payment requirements. Effective tax planning for startups means understanding where you owe taxes before those agencies send notices demanding overdue returns and penalties. Your obligations expand as you hire employees, generate revenue in new states, or open physical locations, so you need systems that adapt as your business grows.

Federal registration and employment taxes

You must obtain an Employer Identification Number (EIN) from the IRS before you hire anyone or open a business bank account. Once you have employees, you face quarterly Form 941 filings for federal income tax withholding and FICA contributions, plus annual Form 940 for federal unemployment tax. If you operate as a C-corporation, you file Form 1120 annually and may need to pay estimated taxes quarterly using Form 1120-W if you expect to owe more than $500. These deadlines don't flex based on your fundraising schedule or product launches, so you need to track them from day one.

State nexus and sales tax triggers

Physical presence isn't the only factor that creates state tax obligations anymore. Economic nexus rules now trigger income tax and sales tax duties based on revenue thresholds, transaction counts, or employee locations in each state. If you sell software subscriptions or physical products across state lines, you may need to register, collect, and remit sales tax in dozens of jurisdictions. Local taxes add another layer, particularly in cities like New York or San Francisco that impose separate business taxes or gross receipts levies.

Ignoring nexus obligations doesn't make them disappear; it just turns them into larger problems with compounding penalties when states eventually catch up.

Use deductions and credits to extend runway

Tax planning for startups goes beyond filing accurate returns; it means capturing every deduction and credit that puts money back into your operating account. Federal and state tax codes include specific provisions designed to support early-stage companies, but you lose them if you don't track expenses correctly or understand which activities qualify. These benefits can return thousands of dollars in the first year alone, capital that directly extends how long you can operate before needing additional funding.

R&D tax credits for product development

You qualify for the R&D tax credit if you're developing new software, improving existing products, or solving technical problems that require experimentation. This credit applies to wages paid to developers and engineers, cloud computing costs for testing environments, and contractor fees for qualified research activities. Small businesses can apply up to $500,000 of this credit against payroll taxes each year, even if you have no income tax liability yet. You need contemporaneous documentation showing what you tested, why you tested it, and how you evaluated results, so build tracking into your project management workflow rather than reconstructing it at year-end.

The R&D credit rewards the development work you're already doing; you just need to document it properly to claim the benefit.

Startup costs and organizational expenses

The IRS lets you deduct up to $5,000 in startup costs and another $5,000 in organizational expenses in your first year, with the remainder amortized over 15 years. Qualifying expenses include market research, legal fees for incorporation, and costs to evaluate potential business locations before you open. You must incur these expenses before you begin operations, and you need receipts and contracts that clearly separate them from ongoing operational costs that follow different deduction rules.

Build a cash flow and compliance system

Effective tax planning for startups requires systems that track money movement and ensure you never miss a filing deadline. You need visibility into when cash arrives and leaves your accounts so you can set aside funds for quarterly tax payments before you spend them on operations. Building these systems early prevents the scramble that happens when a tax bill arrives and you've already allocated every dollar to payroll or product development.

Track inflows and outflows monthly

You should review your bank statements and accounting records every 30 days to understand your burn rate and identify when you'll need to make tax payments. This monthly review helps you spot patterns in customer payments, vendor expenses, and employee costs that affect your tax obligations. Set aside 25% to 30% of any profit into a separate tax reserve account so the money exists when quarterly estimated payments come due. Software like QuickBooks or Xero can automate transaction categorization, but you still need to reconcile accounts manually to catch errors before they compound across multiple months.

Automate reminders for tax deadlines

Federal quarterly deadlines fall on April 15, June 15, September 15, and January 15, while state due dates vary by jurisdiction. You face penalties starting at 0.5% per month on unpaid balances if you miss these dates, and interest compounds daily on top of that. Create calendar alerts 30 days before each deadline so you have time to calculate what you owe, move funds, and file returns without rushing. Most payroll systems will remind you about employment tax deposits, but you need separate tracking for income tax estimates, sales tax filings, and annual returns.

Missing a single quarterly payment can trigger underpayment penalties that eliminate the value of deductions you worked all year to capture.

Next steps

You now understand how tax planning for startups shapes your runway, your investor readiness, and your long-term exit outcomes. The strategies covered here work best when you implement them before problems appear, not after the IRS sends notices or investors request clean records during diligence. Most founders wait until tax season to think about structure and compliance, which means they've already missed opportunities to preserve capital through credits and deductions.

Start by reviewing your current entity structure and confirming you've registered in every jurisdiction where you operate. Document your development activities monthly so you can claim R&D credits without reconstructing work later. Set up separate accounts for tax reserves and create calendar reminders for quarterly deadlines so you never face penalties from missed payments.

Tax Experts of OC works with startups nationwide to build these systems from day one. Our CPAs and Enrolled Agents offer a 30-minute free consultation to review your specific situation and identify immediate opportunities. Schedule your consultation to get your tax planning aligned with your growth strategy.