If you're self-employed, a freelancer, or a sole proprietor, you're required to report your business income and expenses on Schedule C (Form 1040). Finding clear IRS Schedule C instructions can feel overwhelming when you're staring at a blank form, unsure which lines apply to your situation. Getting this form right directly impacts how much you owe or get back at tax time.

Schedule C determines your net profit or loss, which flows to your personal tax return and affects your self-employment tax calculation. Mistakes here, whether from misclassifying expenses, forgetting deductions, or entering figures on the wrong lines, can trigger IRS notices or leave money on the table. Accuracy matters, and so does understanding what the IRS actually expects from you.

At Tax Experts of OC, our CPAs and Enrolled Agents help sole proprietors and small business owners across all 50 states file correctly and maximize legitimate deductions. This guide walks you through Schedule C line by line, explaining what goes where, which expenses qualify, and how to avoid common errors that could cost you.

What Schedule C is and who must file

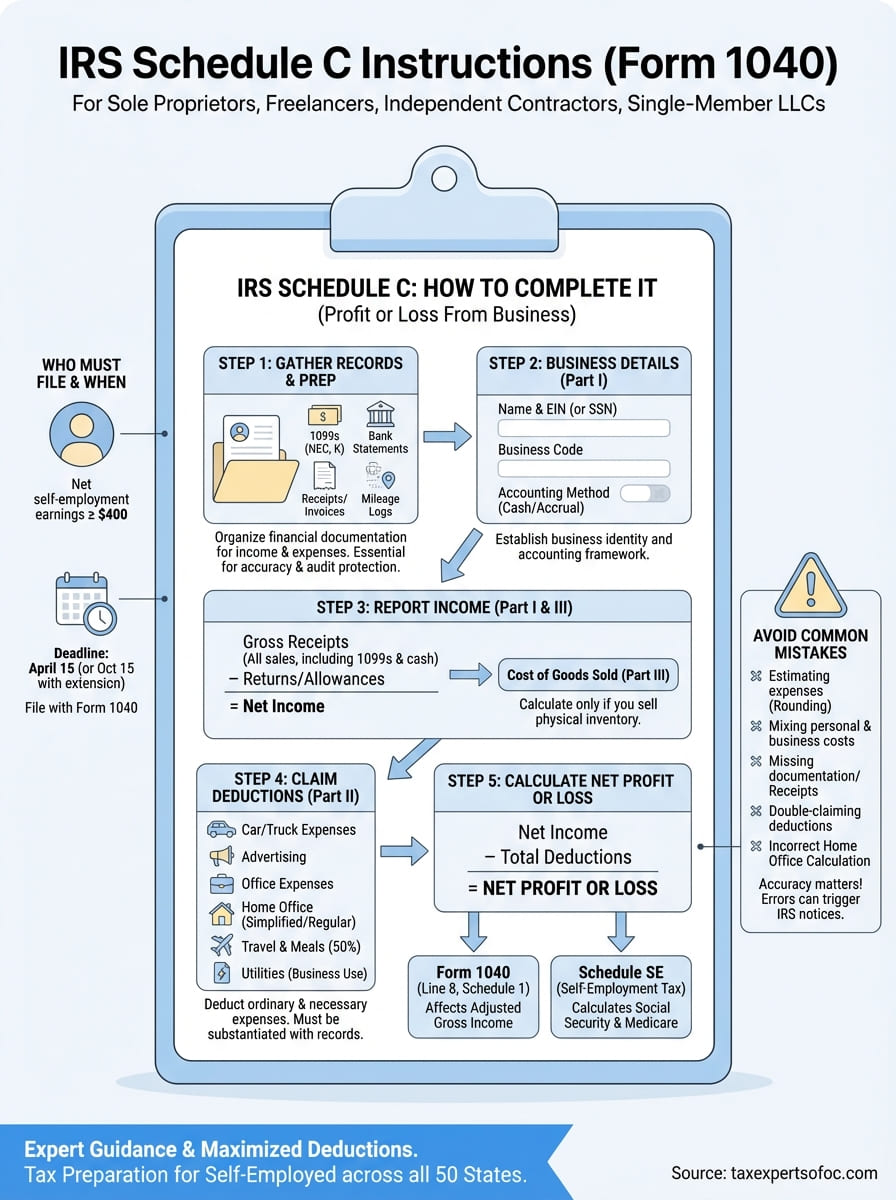

Schedule C (Profit or Loss from Business) is the IRS form that sole proprietors, independent contractors, and single-member LLC owners use to report business income and expenses on their personal tax return. This form calculates your net profit or loss, which then transfers to Form 1040, Line 8, and determines both your income tax and self-employment tax obligations. You file Schedule C alongside your annual Form 1040 by the April tax deadline (or October if you file an extension).

The IRS uses Schedule C to distinguish between your business activity and personal income. Every dollar you earn from self-employment counts as business income, and every legitimate business expense reduces your taxable profit. Understanding these irs schedule c instructions helps you report correctly and claim all deductions you're entitled to without triggering audits.

Business types that require Schedule C

You must file Schedule C if you operate as a sole proprietor without employees or partners. This includes freelancers, consultants, gig workers, online sellers, landlords with rental properties managed as a business, and anyone who provides goods or services under their own name. Single-member LLCs also file Schedule C unless they elect to be taxed as a corporation.

Independent contractors who receive Form 1099-NEC from clients fall into this category. If you're a rideshare driver, graphic designer, writer, photographer, or handyman, you report your income on Schedule C. The same applies if you run a side business while working a W-2 job. Even small operations like selling crafts on Etsy or offering tutoring services require Schedule C filing when you show a profit motive.

If you earned any self-employment income during the tax year, the IRS expects you to report it on Schedule C, regardless of whether you received a 1099 form.

Income thresholds that trigger filing

You must file Schedule C if your net self-employment earnings reach $400 or more during the tax year. This $400 threshold triggers your obligation to pay self-employment tax, which covers Social Security and Medicare contributions. Gross income doesn't matter in this calculation; you only look at your net profit after subtracting business expenses.

Filing requirements apply even if you operated your business for just part of the year or ran multiple small ventures. If you earned $200 from freelance writing and $300 from pet sitting, your combined $500 triggers the filing requirement. The IRS considers all self-employment income together when determining whether you crossed the threshold.

When you don't need Schedule C

You skip Schedule C if you're an employee who receives only W-2 income from your employer. Partnerships file Form 1065 instead, and each partner receives a Schedule K-1 showing their share of business income. Multi-member LLCs follow partnership tax rules unless they elect corporate treatment.

Hobby income that doesn't show a profit motive goes on Schedule 1, Line 8z, and you can't deduct expenses against hobby income under current tax law. If you lose money on your activity for three or more years out of five, the IRS may reclassify it as a hobby rather than a business. Corporations file Form 1120 or 1120-S, not Schedule C, because they're separate legal entities for tax purposes.

Gather what you need before you start

Completing Schedule C accurately requires specific financial records from your entire tax year, not just rough estimates or incomplete statements. You need detailed documentation of every income source and business expense to satisfy IRS requirements and maximize your deductions. Organizing these documents before you start saves hours of frustration and reduces the chance of filing errors that could trigger an audit.

The IRS expects you to substantiate every number you enter on Schedule C with contemporaneous records like bank statements, receipts, invoices, and mileage logs. Missing documentation means you'll either skip legitimate deductions or face penalties if the IRS questions your return. Following these irs schedule c instructions for document preparation puts you in control of the filing process from the start.

Income records you must collect

You need all Form 1099-NEC and 1099-K statements from clients and payment processors who paid you $600 or more during the year. These forms report your income directly to the IRS, so your Schedule C totals must match or exceed what they show. Download complete statements from payment platforms like PayPal, Stripe, Venmo for Business, and Square that show your gross receipts.

Pull bank statements for any business accounts and identify deposits that represent business income. If you accepted cash or checks, gather invoices, sales receipts, or a sales log that documents these transactions. For online sellers, download your sales reports from Amazon, eBay, Etsy, or other marketplaces showing total revenue.

Expense documentation the IRS expects

Organize receipts for every business purchase throughout the year, including supplies, equipment, software subscriptions, advertising costs, and professional services. Credit card and bank statements work as backup documentation, but detailed receipts showing what you purchased strengthen your position if audited. Keep mileage logs that record date, destination, purpose, and miles driven for business trips if you're claiming vehicle expenses.

The IRS can disallow deductions entirely if you can't produce adequate records during an audit, even if the expenses were legitimate business costs.

Collect proof of home office square footage and total home square footage if you're claiming the home office deduction. Gather utility bills, mortgage statements, or rent receipts to support this calculation.

Additional forms that connect to Schedule C

You'll need Form 1099-INT for business account interest and Form 1099-DIV if your business owns investments. If you paid contractors $600 or more, confirm you issued Form 1099-NEC to them. Pull depreciation schedules from prior years if you're continuing to depreciate assets, or gather purchase documentation for new equipment you'll depreciate this year.

Step 1. Fill out the business details section

The top section of Schedule C collects basic identifying information about your business that the IRS uses to track your filing history and match your return against third-party reporting. You complete lines A through J before moving to income and expenses, establishing your business identity and accounting framework. These irs schedule c instructions for the header section determine how the IRS processes your entire form.

Lines A through C: Name and business identification

Enter your business name exactly as it appears on official documents like your EIN application, business license, or DBA filing. If you operate under your personal name without a separate business name, write your full legal name. Leave line A blank only if you've never registered a business name and conduct all activity under your Social Security number.

Line B asks for your principal business code from the IRS list found in the Schedule C instructions booklet. This six-digit code categorizes your primary business activity for statistical purposes. A graphic designer uses 541430, while a rideshare driver enters 485310. Pick the code that best describes where you earn most of your income if you run multiple ventures.

Write your business address on line C. Use your home address if you work from home and have no separate business location. Post office boxes don't count as principal business addresses unless you have no physical location.

Line D: Employer identification number

Check "Yes" on line D if you have an EIN (Employer Identification Number) from the IRS and write the nine-digit number in the box provided. You need an EIN if you pay employees, operate as a partnership or corporation, or file employment or excise tax returns. Most sole proprietors without employees check "No" and use their Social Security number to file Schedule C.

Applying for an EIN takes minutes online through the IRS website, and you receive your number immediately upon completion of the application.

Lines E through J: Business operations and accounting

Line E requires you to select your business category from the provided checkboxes. Most freelancers and consultants check "Professional services," while product sellers mark "Retail" or "Wholesale." Line F asks whether you participate in your business materially, which determines passive activity loss rules. Check "Yes" if you work in the business regularly.

Select your accounting method on line G. Cash basis means you report income when received and expenses when paid, which works for most small businesses. Accrual basis records income when earned and expenses when incurred, regardless of cash movement. Line H asks if you started or acquired the business this year. Lines I and J deal with payments to contractors and filing requirements for Form 1099-NEC.

Step 2. Report income and cost of goods sold

Part I of Schedule C captures all money your business brought in before subtracting any expenses, while Part III calculates the cost of inventory you sold if your business involves physical products. You report gross receipts and sales first, then adjust for returns and allowances to arrive at your true income figure. These irs schedule c instructions for the income section form the foundation of your entire tax calculation.

Lines 1 through 7: Gross receipts and returns

Line 1 asks for your total gross receipts or sales from all business activities. Add up every payment you received, including cash, checks, credit card payments, and electronic transfers. This number should match or exceed the total from all your 1099 forms combined. If you received $45,000 reported on Form 1099-NEC and another $8,000 in cash payments, you enter $53,000 on line 1.

Report returns and allowances on line 2 if you refunded money to customers or gave discounts after the original sale. Subtract line 2 from line 1 to get line 3, your net gross receipts. Lines 4, 5, and 6 cover other income sources like interest earned on business accounts, state tax refunds related to business expenses, or miscellaneous income not captured elsewhere. Add lines 3 through 6 to calculate line 7, your total gross income.

Part III: Cost of goods sold calculation

You complete Part III only if you manufacture products, purchase inventory for resale, or maintain stock as part of your business model. Skip this section entirely if you provide services without selling physical goods. Part III asks for your beginning inventory value, purchases made during the year, labor costs, materials and supplies, and ending inventory to calculate what it actually cost you to produce the items you sold.

Line 33 shows your inventory method: cost, lower of cost or market, or other. Most small businesses use the cost method. Line 35 requires your beginning inventory value from last year's ending inventory, while line 36 captures all purchases. Line 42 calculates your total cost of goods sold, which transfers to Schedule C, line 4, reducing your gross income.

Cost of goods sold represents only the direct costs of producing items you actually sold, not general business expenses like rent or advertising.

When you skip the cost of goods sold section

Service providers like consultants, designers, writers, coaches, and most freelancers leave Part III blank because they don't carry inventory. You also skip this section if you're a rideshare driver, pet sitter, or virtual assistant since these businesses involve labor and expenses but no physical products. Report your gross receipts on line 1 and move directly to the expense section in Part II.

Step 3. Claim deductions and avoid common mistakes

Part II of Schedule C lists expense categories you can deduct to reduce your taxable business income, covering lines 8 through 27b. You claim every legitimate business expense here, but only costs that are ordinary and necessary for your specific type of business qualify. Following these irs schedule c instructions for the deduction section protects you from audit triggers while ensuring you don't leave money on the table.

Common deductible expenses you can claim

Line 9 covers car and truck expenses, where you either claim actual costs (gas, repairs, insurance, depreciation) or use the standard mileage rate of 67 cents per mile for 2024. Advertising costs on line 8 include website hosting, social media ads, business cards, and promotional materials. Line 11 captures contract labor payments you made to other businesses or freelancers for services.

Office expenses on line 18 include supplies like paper, pens, printer ink, and postage for business correspondence. You deduct legal and professional fees on line 17 when you pay attorneys, accountants, or consultants for business advice. Line 25 captures utilities for a dedicated business location, while line 30 handles your home office deduction if you use part of your home exclusively for business.

The IRS disallows deductions for personal expenses mixed with business use unless you can prove the exact business percentage through detailed records.

Travel expenses on line 24a include airfare, hotels, and meals (50% deductible) for business trips. Report business insurance premiums on line 15 and business loan interest on line 16a. Line 27a lets you list other expenses not covered by specific categories, such as merchant processing fees, professional dues, education courses, or software subscriptions directly related to your business operations.

Mistakes that trigger IRS scrutiny

You create red flags when you claim 100% home office deduction on a small apartment or deduct every meal as a business expense without proper documentation. Rounding all expense figures to even hundreds suggests estimation rather than actual record-keeping. The IRS questions returns where total expenses consistently equal 90% or more of gross income for multiple years, indicating either poor record-keeping or aggressive deduction claims.

Claiming vehicle expenses using both the standard mileage rate and actual costs on the same return violates IRS rules. You can't deduct commuting miles from home to your first client location or personal trips mixed with business errands. Watch for math errors when adding expense categories or transposing numbers between forms, which computers flag immediately during processing.

Step 4. Calculate net profit and file the return

The final section of Schedule C brings together your income and expenses to determine your net profit or loss, which directly affects your tax liability and self-employment tax obligation. You complete lines 28 through 31 to arrive at your bottom-line figure, then transfer this amount to Form 1040 where it combines with your other income sources. These irs schedule c instructions for the calculation section ensure you report your final profit accurately and understand what happens next in your tax filing process.

Lines 28-31: Calculate your net profit or loss

Subtract line 28 (total expenses from Part II) from line 7 (gross income) to get your tentative profit or loss on line 29. If line 29 shows a profit and you have expenses for business use of your home, you can claim the home office deduction using either the simplified method (line 30) or the regular method (Form 8829). The simplified method allows $5 per square foot up to 300 square feet, while the regular method requires detailed allocation of actual home expenses.

Line 31 shows your net profit or loss after home office deduction, which becomes your final Schedule C result. A positive number means your business made money, while a negative number indicates a loss. You'll owe self-employment tax (Social Security and Medicare) on any profit exceeding $400, calculated on Schedule SE and added to your Form 1040.

Connect Schedule C to your Form 1040

Transfer your net profit from Schedule C, line 31 to Schedule 1, line 3 of Form 1040, which feeds into your total income calculation. Your business profit combines with wages, interest, dividends, and other income to determine your adjusted gross income. If you showed a loss, it reduces your total taxable income from other sources, potentially lowering your overall tax bill.

Schedule SE calculates 15.3% self-employment tax on your net profit, covering both the employer and employee portions of Social Security and Medicare.

Calculate your self-employment tax separately using Schedule SE, then report it on Schedule 2, line 4 of Form 1040. You can deduct half of your self-employment tax as an adjustment to income on Schedule 1, line 15, which reduces your taxable income.

Filing deadlines and submission methods

File Schedule C attached to your Form 1040 by April 15, 2026 for the 2025 tax year, or October 15, 2026 if you file an extension using Form 4868. You can submit electronically through IRS Free File, commercial tax software like TurboTax or H&R Block, or by mailing a paper return to the IRS address listed in Form 1040 instructions for your state. Electronic filing provides faster processing, immediate confirmation, and quicker refunds if you're due money back.

Next steps

Filing Schedule C correctly protects you from IRS notices and ensures you claim every deduction you've earned through your business operations. You now have the irs schedule c instructions you need to report income, track expenses, and calculate your net profit without common mistakes that trigger audits. Review your documentation one more time before filing to catch any missing receipts or calculation errors that could reduce your refund or increase what you owe.

Complex situations benefit from professional review. If your Schedule C involves inventory calculations, significant equipment depreciation, multiple business activities, or home office deductions that require detailed Form 8829 calculations, expert guidance prevents costly errors. Tax professionals identify deduction opportunities you might overlook and represent you if the IRS questions your return.

Tax Experts of OC provides Schedule C preparation and review services through our team of CPAs and Enrolled Agents. We help self-employed clients across all 50 states maximize legitimate deductions while maintaining full IRS compliance through secure remote consultations.